Non-Life Insurance November 2019

Here’s why your general insurance premium may rise by 10-15% after January 1:

Both group and individual policies may see a 10 -15 percent hike in premiums in 2020.

The New year is likely to make your wallets lighter since there is likely to be a higher outgo on your general insurance premium. Sources told Money control that the insurance premiums are set to rise by 10 – 15 percent in 2020.

This is on account of a rise in reinsurance rates, which insurance companies have to pay to secure a cover. When insurance companies pay a higher amount to get the same risk covered, this excess if passed on to customer in the form of a premium increase. Renewals of reinsurance contracts begin from January 1.

Considering the risks involved in the business, almost all general policies are reinsured by insurance companies. In other words, they buy a cover for themselves in case the insurers themselves are hit with a large claim.

There has been a consistent rise in incidences of claims. This had led to both Indian and global reinsurers taking a cautious stance as far as providing covers are concerned. They have already indicated that reinsurance rates will go up, said the underwriting head at a large general insurance company.

Sources said premiums in segments like liability insurance, fire insurance, motor insurance as well as group health covers will take a 10 – 15 percent hit in the form of an increase.

A group of fire insurance policies for certain types of buildings / occupancies are being offered at a discount despite having a history and clear data of higher claims previously This is affecting balance sheets since clients tend to choose those insurers whose premiums are lower, said the chief operating officer at a midsize private insurer.

Sometimes a higher claim in one segment may end up increasing the overall claims losses for an insurance company. In FY 20, crop insurance losses have been higher due to the incidents of floods affecting production. This is also a factor leading to a price increase.

Among retail segments, it is likely that the impact in the motor insurance segment could be higher. This is because the mandatory third-party insurance premium (fixed by IRDA) may see another partial increase from April 2020 onwards. Due to this, rates of comprehensive motor policies may go up.

A few year ago, in a bid to retain corporate clients, several insurers would indulge in discounting practices to retain corporate clients. While this practice still exists, discounts have reduced since the listing of insurance has ushered transparency in the sector.

Underwriting profit and combined ratio are now two closely watched metrics by shareholders of insurance companies. Discounting loss – making businesses impacts the bottom line and hence this is being passed in the form of higher premium.

Why your smartphone, too, needs an insurance policy:

Not only in India one of the biggest smartphone markets, but Indians are also richly invested towards accessorizing their phones with unique phone cases, headphones, power banks etc. As per recent report, the market for mobile phone accessories is projected to gamer $ 3.54 billion by the end of 2024, growing at a CAGR of 10.5% over the period.

The biggest factor contributing towards this is the rising young population who use accessories such as phone cases as a style statement to differentiate their phones from their peers. The protective screen guard is also a top choice since we all are aware of the costs associated with a damaged screen. While at this, the e-commerce sector has also introduced mobile insurance policies, which at nominal prices, compensate for the loss incurred due to any accidental means such as theft, screen damages, water damage etc.

There are, however, other policies that are of utmost importance for your cellphones.

When health insurance delays your hospital discharge:

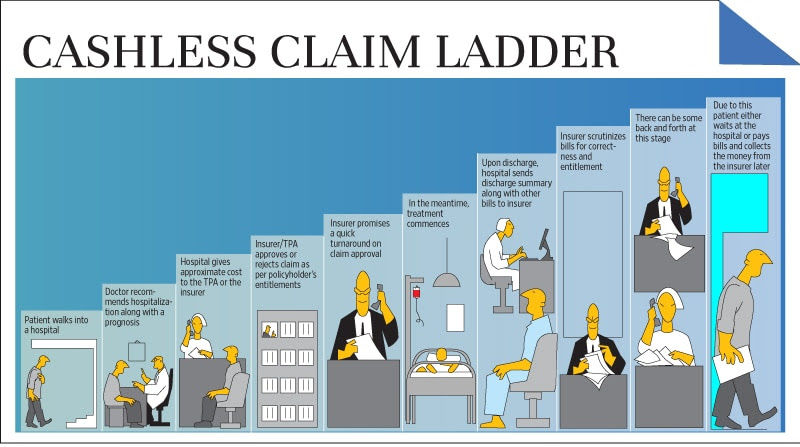

Been at the hospital for a couple of days and now that you are fit, you crave home food and comfort. The doctor comes on a round and declares you fit for discharge and so you pack your bags thinking you will be able to walk out of the hospital the very next minutes. But then the hospital staff tells you to have patience and that’s what you lose every single minute as you see your family running around to get the bills cleared. It’s now evening and you are still stuck because your health insurance claims has not been cleared and the hospital won’t discharge you unless the insurer signed off on the bills. This is not an aberration, but a common experience among the insured patients who make cashless claims.

Insurance claims ins India re generally delayed as there is no single point where claims can be verified. Also, hospitals and medical day – care centers are not listed on one platform due to which processing of insurance claims gets delayed. In an age where everything has become digital, electronic exchange of medical records between hospitals and insurance companies has to become seamless, said a spoke person from GS1 India, an industry standards body.

The insurer in a cashless claim is usually the faceless entity as you are dealing primarily with the health insurance desk of the hospital and so you may think that the insurance company is taking their sweet time to settle bills, realizing that your hospital too could be guilty of delaying the whole process. It’s therefore important to understand the process.